are hearing aids tax deductible in 2020

For example you would use this line if you purchased hearing aids for your spouse at some point in 2020. Keep in mind due to Tax Cuts and Jobs Act tax reform the 75 threshold applies to tax years 2017 and 2018.

For goods and services not required or used other than incidentally in your personal activities.

. Examples of qualifying health expenses are payment for. Are hearing aids tax-deductible for 2020. Rainbow Desert Inn 3120 S Rainbow Blvd Ste 202 Las Vegas Nevada 89146 702-997-2964 Henderson 2642 W Horizon Ridge Ste A11 Henderson Nevada 89052.

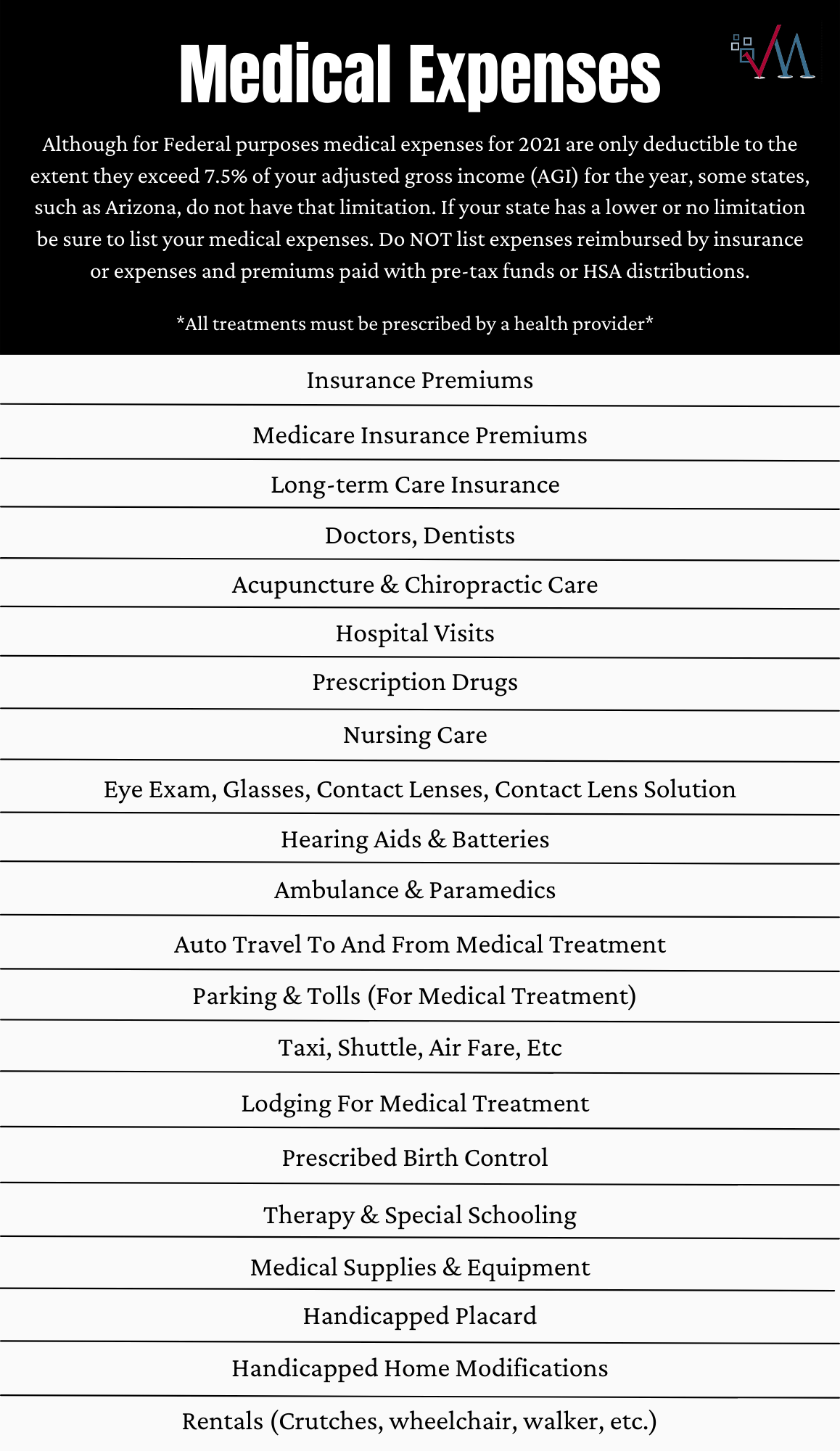

Unfortunately it seems uncommon knowledge that the IRS will allow tax deductions for hearing aids and some associated items listed as medical expenses. Most insurance does not cover or only covers partially the cost of. Only medically required equipment is eligible to be deducted.

Related

- sweet art bakery in pembroke pines

- best bbq in tennessee reddit

- philadelphia wage tax refund 2020

- trucking companies in mobile alabama

- dahlia flower meaning in marathi

- online class memes in hindi

- best custom home builders in colorado

- cheap hotels in sulphur springs texas

- does medicaid cover braces in georgia

- patient transport jobs in hospitals

Claiming deductions credits and expenses. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs. Qualifying health expenses are for health care you have paid for.

Can hearing aids be deducted as a business expense. Many of your medical expenses are considered eligible deductions by the federal government. Since hearing loss is.

Hearing aids or personal. Medical expenses that exceed 7 percent of a taxable income cannot be deducted as an expense. Polite quotes for whatsapp.

104 Gilbert AZ 85234 irs letter 6419 when will i get it Call Us Today. June 3 2019 1222 pm. If the corporation could deduct the 1 million expense this year it would get a bonus windfall of 210000 or potentially 350 000 if it could carry back losses to years before 2018.

Are The Cost Of Hearing Aids. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria. What Medical Expenses Are Tax.

Are hearing aids tax. The standard deduction for 2022 is 12950 for single filers and married filing separately 19400 for heads of household and 25900 for married couples filing jointly. Doctors and consultants services.

Expenses related to hearing aids are tax. After 2018 the floor returns to 10. Hearing aids batteries maintenance costs and repairs are all deductible.

Costco hearing aids with insurance can still cost you a few hundred dollars or even 1000. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid. Are hearing aids tax deductible in 2020.

Are hearing aids tax deductible in 2020. If you have questions about what deductions you qualify for - or how you can better calculate your expenses to deduct them from your taxes we recommend talking with a tax expert. 502 Medical and Dental Expenses.

After 2018 the floor returns to 10. Tax offsets are means-tested for people. As of mid-2020 there are no tax credits for hearing aids.

Personal income tax. You would claim the amount in this section to get the proper tax. Lines 33099 and 33199 Eligible medical expenses you can claim on your tax return.

Hearing aids batteries maintenance. The cost of hearing aids can be as high as 75 of your adjusted gross income so. The deductions for these costs are only available to those who itemize their expenses.

Tax Tips For The Deaf Turbotax Tax Tips Videos

2021 Taxes A Comprehensive Guide To Filing Money

Hearing Amplifiers Vs Hearing Aids Differences Pros Cons

Are Hearing Aids Tax Deductible Anderson Audiology

Hearing Access Program Better Hearing Australia

Are Hearing Aids Tax Deductible What You Should Know

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Are Medical Expenses Tax Deductible

Paying For Hearing Aids Tax Breaks From Uncle Sam With Hsas And Fsas

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The Cost Of Hearing Aids In 2022 What You Need To Know

Are Hearing Aids Tax Deductible Anderson Audiology

Children S Hearing Aids Program May Expand Calmatters

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Commonly Overlooked Tax Deductions

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Hearing Aid Prices How Much Do Hearing Aids Cost In 2022

Hear The World Foundation High Quality Hearing Healthcare For Ukraine Hear The World Foundation

Hearing Aid Provider Audiology Professionals Jacksonville Fl